About Orange Mortgage

Orange Mortgage, a prominent financial organization in Canada, has been leading the way in offering personal loans to people, enabling them to pursue their dreams and attain their monetary objectives.

The outstanding collaboration between Orange Mortgage, a well-known financial organization that offers private loans in Canada, and PPC Studio, a top-notch digital marketing agency that specializes in Performance Marketing, is exemplified in this case study.

Objectives

Orange Mortgage had a specific objective in mind when they approached us (PPC Studio) – to obtain superior leads while keeping costs low. In an effort to enhance their return on investment and broaden their presence in the competitive lending industry, Orange Mortgage enlisted the aid of PPC Studio to create and execute a successful Google Ads campaign. They aimed to catch the interest of Canadian individuals who were actively seeking private loans, with the ultimate goal of directing qualified leads to their website

The Challenge

We encountered a significant hurdle while collaborating with Orange Mortgage, which involved promoting their mortgage services that catered exclusively to self-employed individuals. This particular group of customers posed distinct challenges as they constituted a specialized subset within the lending industry.

It was challenging to effectively target the desired audience due to the significantly low search volume for keywords related to self-employed mortgages. Moreover, running ads in Canada, where cost-per-click rates are typically higher, presented an additional obstacle in managing the campaign within a limited budget.

We acknowledged the necessity of surmounting these obstacles and developing a well-planned strategy to enhance the campaign’s influence and produce quantifiable outcomes for Orange Mortgage.

Our Approach

We, PPC Studio adopted a comprehensive approach to help Orange Mortgage overcome the challenges they faced in promoting their specialized mortgage services for self-employed individuals. Our first step was to conduct a detailed analysis of the landing page, identifying areas for improvement. We then strategically placed compelling call-to-action buttons and optimized the overall layout and design, with the goal of enhancing user engagement and encouraging desired actions.

During the campaign, our focus was on consistently improving performance. We kept a close eye on the optimization score and made frequent modifications to campaign settings, keywords, and ad creatives. By doing this, we were able to make the most of our advertising budget and achieve optimal results. We also carried out A/B testing to determine the most effective ad variations and designed eye-catching graphics that were strategically placed on platforms such as YouTube, Google Display, and Discovery ad campaigns.

To attract the intended audience, we utilized custom audience targeting techniques specifically designed for the Canadian market. By conducting a comprehensive market analysis, we pinpointed the perfect target audience and employed custom interest targeting to display advertisements to users actively searching for relevant keywords. This strategy aided us in expanding the reach and visibility of Orange Mortgage’s services to the appropriate individuals.

Result

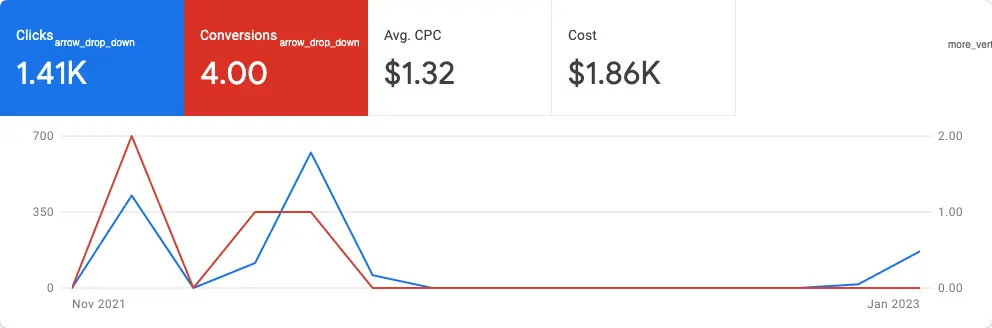

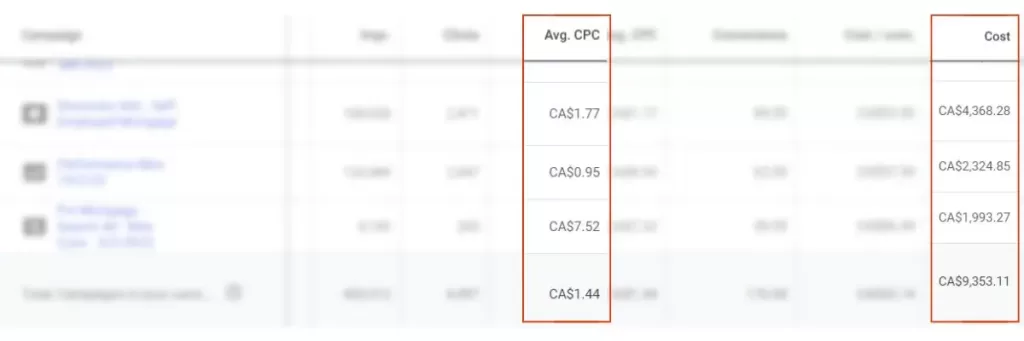

Our strategic marketing plan for Orange Mortgage produced impressive results. In January and February, the cost per acquisition (CPA) was $70, but we were able to lower it to $48 on an average in March by continuously optimizing and fine-tuning our campaigns. This substantial increase in cost efficiency allowed Orange Mortgage to generate more leads while reducing their marketing expenses.

Our marketing strategies for Orange Mortgage proved to be highly successful as evidenced by the remarkable impact of our efforts. Within a short period, their lead count surged from just 4 leads obtained with an investment of $1,860 to an impressive 180 leads, all while managing a budget allocation of $11,000. This substantial increase in lead generation and optimized campaign performance highlights our ability to drive outstanding results.

Conclusion

In conclusion, Orange Mortgage achieved their goal of generating top-notch leads for their mortgage services aimed at self-employed individuals through a successful collaboration with PPC Studio. Our all-inclusive and well-planned approach caused a noteworthy reduction in the cost per acquisition and a considerable rise in lead numbers. By relying on data-driven marketing tactics and ongoing optimization endeavors, Orange Mortgage accomplished their desired outcomes and stimulated business expansion.

31.43%

CPA Reduction

4300%

Leads Increment

$1.42

Average CPC

Your Business Growth Partner

Supercharge Your Business’s Revenue. Partner with a Premier Digital Marketing Agency